jennaharte

The Ultimate Romance Author Event Checklist: What to Bring, Say, and Do

March 18, 2025 in Blog

I’m a big fan of events for authors. Not only can you learn about being an author and sell books, but there’s an energy that comes from being around other authors and readers that can boost your motivation.

Attending events, whether in-person or virtual, is a fantastic opportunity for authors to connect with readers, network with industry professionals, and promote their books. Whether you’re attending a book signing, speaking at a conference, or participating in a virtual panel, being well-prepared can make all the difference. Here’s a step-by-step guide to ensure you’re ready for your next author event.

1. Define Your Event Goals

Before you dive into preparation, consider what you want to achieve.

Personally, I try to do all of this, but maybe you just want to sell books or pitch agents. Whatever your goal is, understanding your objectives will help shape your preparation and measure success.

2. Research the Event and Audience

Not all events are the same. Some are reader focused while others are writing focused. Knowing what sort of event you’re attending can help you determine what books to sell and what you’ll say if you’re leading a workshop or on a panel. For example, when I go to writing events, I bring many more of my non-fiction books geared toward helping writers than my fiction books. If I’m at a romance signing event, I bring many more romances than mysteries.

If I’m speaking to other writers, I tend to give information that could be helpful to them. If I’m speaking to readers, I discuss tidbits and factoids that would be interesting and hopefully encourage them to check out my books.

Tip: If you’re a speaker or panelist, research your fellow participants and their work to foster meaningful discussions.

3. Promotional Materials and Branding

This is one area you want to make sure you’re prepared. Consider all the ways you can connect with readers and writers, and have materials that you can easily share so they can remember you long after they’ve left the event.

Pro Tip: If you’re launching a book at the event, offer pre-order options or event-exclusive bonuses.

4. Prepare Your Pitch & Talking Points

Whether you’re speaking at a panel, engaging with readers, or chatting with industry professionals, practice your elevator pitch:

You’ll want a practiced pitch if you’re meeting with agents. With readers, I like to ask, “What do you like to read?” to get a sense of their preferences so I can skew my pitch to their interest.

If you’re doing a reading or live Q&A, rehearse ahead of time and choose engaging excerpts that will hook listeners. Many panel moderators will be in touch with you before the event with sample questions so you can think about what you want to say beforehand.

5. Engage with Attendees Before, During, and After

Writing is a solitary activity, perfect for introverts. But you’ll need to get over that at an event. Readers love to talk with authors about what they do. For many, writing seems like a magical superpower. That’s why they go to events. Before an event, let your readers know where you’ll be:

- Before: Announce your attendance on social media, your website, and your newsletter.

- During: Post live updates, interact with attendees, and use event hashtags. Even if you’re not a drinker, head to the bar (if the event is in a hotel or restaurant) as this is a great place to meet and greet readers and writers. If there are special events going on, attend them. For example, some events have pre-event meet and greets or after event hors d’oeuvres and cocktails.

- After: Follow up with new contacts, send thank-you messages, and share a recap on your blog or social media.

6. Tech & Logistics Checklist

Ensure a smooth experience with these must-dos:

For virtual events:

7. Take Care of Yourself

Book events can be grueling.

8. Measure Your Success & Follow Up

After the event, evaluate how things went:

- How many books did you sell?

- How many new newsletter subscribers did you gain?

- What connections or opportunities arose?

- What could you improve for next time?

- What do you need to re-order for your next event?

- Write a follow-up blog post or social media recap to keep the momentum going!

Author events are incredible opportunities to connect, promote, and grow your brand. With thorough preparation, you’ll not only enjoy the experience but also maximize your impact.

Are you planning to attend an author event soon? Share your prep strategies in the comments!

5 Simple Ways to Get Your Writing Back on Track When You’re Stuck

February 18, 2025 in Blog, Writing Romance

Every romance writer experiences moments of being stuck—whether it’s writer’s block, losing motivation, or feeling unsure about your story’s direction. The good news? You can break through the creative fog! Here are five simple ways to get back on track and start writing again.

1. Reconnect with Your Why

- Remind yourself why you started writing this story.

- Reread your original notes, character profiles, or outline.

- Revisit what excites you about this romance, whether it’s a trope, a character, or a particular scene you can’t wait to write.

2. Step Away (But Stay Engaged with Romance)

- Sometimes, taking a break helps more than forcing words onto the page.

- Read a romance novel in a similar genre or trope for inspiration.

- Watch a romantic movie or TV show to reignite your love for storytelling.

3. Try a Different Scene or POV

- If one part of your book is giving you trouble, skip ahead and write a different scene.

- Rewrite a scene from another character’s perspective to gain fresh insight.

4. Change Your Writing Routine

- Switch up your environment. Write in a coffee shop, a library, or even outside.

- Try a new writing method: dictate your scene, use a timer for short writing sprints, or write by hand instead of typing.

5. Brainstorm with a Friend or Writing Community

- Talking through your story with a critique partner or writing group can spark new ideas. (Hint: Join Write with Harte’s member weekly zoom call or join a WWH group to ask your question.)

- Ask open-ended questions: “What if my character did this instead?”

Getting stuck is part of the writing process, but it doesn’t have to derail you. Whether you take a step back, switch things up, or seek support, you can find your way back to writing.

Which of these tips will you try first? Let me know in the comments!

How to Research to Write a Romance Novel

January 28, 2025 in Blog, Tools & Resources, Writing Romance

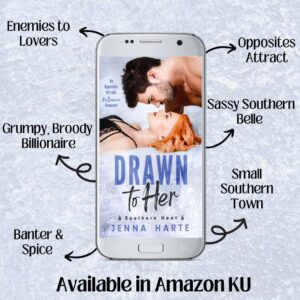

9 Easy Promo Graphics Ideas for Romance Authors

January 21, 2025 in Blog, Marketing, Tools & Resources

Tax Tips for Romance Authors

January 14, 2025 in Blog

Taxes might not be the most romantic topic, but for authors, they’re an essential part of the business. Whether you’re a traditionally published or self-published romance author, or balancing both, understanding taxes can make a significant difference in your bottom line.

Your income might come from multiple streams—book sales from multiple platforms, speaking engagements, merch, or even Patreon supporters—and you might have expenses that range from editing fees to travel for conferences. Navigating these specifics is crucial to avoid overpaying or missing out on deductions that are rightfully yours.

NOTE: I am NOT a tax expert. This information isn’t given as professional advice, but just an FYI. Find a tax expert to help you with your tax questions.

The goal of this guide is simple: to demystify taxes for romance authors and equip you with the tools to manage your finances effectively.

Tax Basics for Romance Authors

As a romance author, you’re more than a writer—you’re also a business owner. Whether you’re penning love stories full-time or as a side hustle, the IRS typically considers authors self-employed. This classification has important implications for how you report income, pay taxes, and manage your finances.

Definition of Self-Employment for Authors

When you earn income from your books, whether through royalties, advances, or other creative endeavors, you’re operating as a self-employed individual. This means you’re responsible for tracking your income and expenses, as well as paying taxes directly to the government. Unlike traditional employees, self-employed authors don’t have taxes withheld from their income, so you’ll need to handle this yourself.

Tax Obligations: Federal, State, and Local

- Federal Taxes: As a self-employed individual, you’ll report your income and expenses on Schedule C (Profit or Loss from Business) and pay self-employment taxes (Social Security and Medicare) through Schedule SE.

- State Taxes: Depending on where you live, you may owe state income taxes. Some states also have additional business tax requirements for self-employed individuals.

- Local Taxes: Certain cities or counties impose local income or business taxes, so check with your local tax authority to ensure compliance.

- Sales Tax (if applicable): If you sell physical books directly to readers, some states require you to collect and remit sales tax. Be sure to research the rules in your area.

Key Dates and Deadlines to Remember

Self-published authors need to keep track of several crucial tax deadlines. These include:

- January 15: Deadline for the final quarterly estimated tax payment for the previous year.

- January 31: Deadline for sending 1099-NEC forms to any contractors you paid over $600 in the previous year.

- April 15: Deadline for filing your annual federal and state tax returns. You can request an extension but any taxes owed are still due.

- June 15, September 15: Deadlines for the second and third quarterly estimated tax payments, respectively, if required.

- October 15: Extended deadline for filing your tax return if you requested an extension.

- December 31: End of the tax year, ensuring that all business expenses are accounted for.

What forms do authors need to file to report their income?

- Schedule C (Profit or Loss from Business): Used to report your business income and expenses. Includes income from 1099 forms (issued by platforms or sources paying you over $600 annually).

- Schedule SE (Self-Employment Tax): Calculates Social Security and Medicare taxes for self-employed individuals. Required if your net earnings from writing are $400 or more. Self-employed authors are responsible for paying both the employer and employee portions of these taxes, totaling 15.3% of their net earnings, but the good news is that you can deduct half of your self-employment tax on Schedule 1, Part II of your tax return, which will reduce your overall taxable income.

- Schedule E (Supplemental Income and Loss): Used to report royalties if you are no longer actively engaged in writing as a business.

- 1099-NEC (Non-Employee Compensation): Must be issued to independent contractors (e.g., editors, cover designers) you pay $600 or more in a year. You’re responsible for providing the contractor with a copy and submitting it to the IRS.

Business or a Hobby? Understanding the “Three Out of Five” Rule

The “three out of five” rule is often cited as a guideline for determining whether your writing is considered a business or a hobby. According to this rule, if your business does not turn a profit in at least three out of five consecutive years, the IRS might classify it as a hobby. That doesn’t mean you can skip paying taxes. All income is taxable no matter where or how it comes. What it can effect is how much you can deduct. Hobbies can only deduct up to the amount they’ve earned, where as a business can take a loss. So if you’ve earned $1,000 but spent $1,200 to earn it, as a hobby you can only deduct $1,000 (earnings) whereas in a business you deducts the whole $1,200 for a $200 loss.

Here’s what else the IRS looks at to distinguish a business from a hobby:

- Time and Effort: Are you devoting significant time and effort to your writing with the intention of making it a profitable venture?

- Business Practices: Do you have a business plan, keep detailed records, and conduct yourself like a professional (e.g., marketing, attending industry events)?

- Profit Motive: Are you actively taking steps to improve your profitability, such as refining your marketing strategies or exploring new income streams?

- Expertise: Have you acquired the knowledge or skills necessary to make your writing business successful?

- History of Earnings: Even if you haven’t been consistently profitable, does your income show a trend toward improvement?

What If You Don’t Turn a Profit?

Don’t panic if your writing hasn’t been profitable every year—especially if you’re still in the early stages. Focus on:

- Growing your writing career with a clear profit motive.

- Keeping thorough records of income, expenses, and the time you invest in your business.

- Demonstrating professionalism in how you approach your writing and publishing activities.

While the “three out of five” rule is a helpful guideline, it’s not the sole determinant of whether your writing is a business or a hobby. The key is showing that you’re treating your writing as a legitimate business and actively working toward profitability.

Income Sources to Report

When it comes to taxes, one of the first steps is knowing what income you need to report. As a romance author, your income may come from a variety of sources, and each one must be documented for tax purposes. Here’s a breakdown of the most common income streams for authors:

Royalties from Book Sales

- Traditional Publishing: If you’re working with a publisher, you’ll receive royalty payments based on your book sales. These royalties are typically reported to you on a 1099-NEC form if they exceed $600 annually. However, you’re required to report all royalties, even if you don’t receive a 1099,.

- Self-Publishing: For indie authors, royalties from platforms like Amazon KDP, Apple Books, and others are considered taxable income. These platforms generally provide you with a 1099-K or similar form if your earnings meet the reporting threshold.

Note that if any of your royalties or other income is payed through PayPal and your total income from all sources is over $600 through PayPal, PayPal will issue a 1099 that you can download through your account. This can cause some bookkeeping challenges if your PayPal is connected to your business account, since you’re at risk of counting a transaction twice. I download the 1099 from PayPal (required for taxes), and two spreadsheets (reports); one with debits and one with credits. I compare this to anything that is on my business account ledger to make sure I include everything I need, but don’t count something twice. Again, an accountant can help you figure out the best way to organize your money if you have multiple sources of income.

Advances from Publishers

Advances are upfront payments from publishers against future royalties. Whether or not you earn out your advance, it is considered taxable income in the year you receive it. Be sure to account for this when estimating your annual income and paying quarterly taxes.

Speaking Engagements, Workshops, or Consulting

If you participate in book signings, teach workshops, or provide consulting services (e.g., manuscript critiques or writing coaching), the income you earn is taxable. Keep a detailed record of fees received, including payments from event organizers or individual clients. These earnings might also be reported to you on a 1099-NEC if they meet the threshold.

Affiliate Income, Patreon, and Other Side Earnings

- Affiliate Income: If you earn money through affiliate programs like Amazon Associates or by promoting writing tools or services, this income must be reported. Affiliate networks may issue a 1099-NEC or 1099-K depending on their policies.

- Patreon or Crowdfunding: Monthly supporter contributions or one-time crowdfunding campaigns (e.g., for a book project) are taxable. Platforms like Patreon often provide a 1099-K if your earnings meet the reporting threshold, but even if they don’t, you must still report this income.

- Other Earnings: Additional income streams, such as selling signed books, offering exclusive merchandise, or hosting virtual book clubs, also count as taxable income.

Best Practices for Tracking Your Income

- Use a spreadsheet or financial tracking software to log all income sources.

- Save all payment confirmations, invoices, and 1099 forms.

- Regularly review your records to ensure all income is accounted for, including smaller streams that can add up over time.

Essential Deductions for Romance Authors

As a romance author, you’re likely spending money to create, market, and distribute your books. The good news is that many of these expenses are tax-deductible, helping to reduce your taxable income. To maximize your deductions, it’s important to understand what qualifies as a business expense and keep thorough records. Basically, if you have to spend it to create or sell your book, then it’s likely tax-deductible.

Here are some common deductions authors can claim:

Writing Tools and Supplies

- Technology: Computers, laptops, tablets, and printers used for writing and publishing.

- Software: Word processing programs, design tools, and productivity apps (e.g., Microsoft Word, Scrivener, Canva).

- Office Supplies: Notebooks, pens, ink, paper, and other essential items.

Professional Services

- Editing and Proofreading: Fees paid to editors or proofreaders to polish your manuscripts.

- Cover Design: Expenses for professional cover design or purchasing pre-made covers.

- Marketing Services: Costs for hiring a marketing consultant, running ads (e.g., on Amazon or Facebook), or paying for promotional services.

Research Expenses

- Books and Resources: Novels, non-fiction books, or other media purchased for research.

- Travel Costs: Expenses incurred while traveling for research purposes, such as transportation, lodging, and meals. For example, if you visit a specific location to accurately depict it in your story, these costs may qualify. Driving for business comes with a mileage deduction.

Home Office Deduction

If you work from home, you may be eligible for a home office deduction, provided the space is used exclusively and regularly for your writing business.

- What qualifies: A dedicated workspace, whether it’s a room or a specific area of a room.

- How to calculate: Use either the simplified method ($5 per square foot, up to 300 square feet) or the actual expenses method, which involves calculating a percentage of your home’s costs (e.g., rent, utilities, and maintenance).

Conference Fees, Memberships, and Subscriptions

- Conferences and Workshops: Registration fees, travel, lodging, and meals for attending writing-related events.

- Professional Organizations: Membership dues for groups like Romance Writers of America (RWA) or local writing associations.

- Subscriptions: Magazines, online platforms, or tools like Publisher’s Marketplace or KDP Rocket.

Education and Training

- Courses and Webinars: Fees for writing or marketing classes, workshops, or webinars.

- Coaching: Payments for personal coaching or mentorship programs focused on writing or business development.

Best Practices for Claiming Deductions

- Keep itemized records of all expenses and save receipts.

- Use accounting software or a dedicated spreadsheet to track expenses by category.

- Keep a notebook in your car or use apps like MileIQ or TripLog (or just notes in your phone) to track mileage when you drive for business purposes such as to events or to the office store to get more paper.

- Ensure all claimed deductions are directly related to your writing business.

Record-Keeping Tips

Good record-keeping is the foundation of smooth and accurate tax preparation. By maintaining organized and detailed financial records, you can save time, reduce stress, and ensure you’re claiming all eligible deductions. Here’s how to set yourself up for success:

Importance of Separating Personal and Business Finances

- Keeping your personal and business finances separate is critical for clear financial reporting and easier tax preparation. The easiest and safest way to do this is to open a separate bank account for your writing business. It doesn’t have to be a business account, unless you formally create a business entity such as an LLC.

- Mixing finances can lead to confusion, missed deductions, or even red flags for an audit.

- Create a clear boundary by treating your writing career as a business.

Recommended Tools and Software for Tracking Income and Expenses

- Accounting Software: Programs like QuickBooks, Wave, or FreshBooks can help track income, expenses, and even generate reports for tax purposes.

- Expense Tracking Apps: Apps like Expensify, Everlance, or Zoho Expense make it easy to categorize and track expenses on the go.

- Spreadsheets: If you prefer a simpler option, a well-organized spreadsheet can work just as well for tracking your income and expenses manually. Many banks now let you download your credits and debits as a spreadsheet.

How to Organize Receipts and Invoices Effectively

- Digital Storage: Use apps like Receipt Bank, Shoeboxed, or even your phone’s camera to digitize paper receipts. Store them in a cloud-based folder for easy access.

- Categorization: Group receipts by category (e.g., supplies, travel, marketing) to align with your deductions.

- Invoices: Keep copies of all invoices you issue for services like consulting or speaking engagements. Maintain a consistent numbering system for better organization.

- Backup: Regularly back up your records on an external hard drive or cloud service to avoid data loss.

Benefits of a Dedicated Business Account

- Easier Tracking: A separate account simplifies tracking business income and expenses, eliminating the need to sort through personal transactions.

- Professionalism: Using a business account establishes credibility and signals to the IRS that you’re running a legitimate business.

- Tax Preparation: Having all business transactions in one place makes it easier to reconcile your records and prepare for tax season.

Pro Tips for Effective Record-Keeping

- Schedule a weekly or monthly “finance day” to review and update your records.

- Keep a mileage log if you drive for business purposes, using apps like MileIQ or TripLog to simplify tracking.

- Store a checklist of tax-deductible expenses to ensure you don’t overlook anything throughout the year.

Common Tax Mistakes to Avoid

Even the most organized romance authors can make mistakes when it comes to taxes. To avoid costly errors and unnecessary stress, it’s essential to know the common pitfalls and how to sidestep them. Here are three mistakes to watch out for:

1. Ignoring Small Deductions

- Why it Happens: Many authors overlook small expenses, thinking they won’t make a difference. However, these small costs can add up significantly over the course of a year.

- Examples of Missed Deductions:

- Subscription fees for tools like Canva or Grammarly.

- Postage and shipping costs for sending signed books or contest prizes.

- Small office supplies like pens, folders, and printer ink.

- How to Avoid It: Track every business-related expense, no matter how minor. Use expense tracking apps or software to ensure nothing slips through the cracks.

2. Missing Quarterly Tax Deadlines

- Why it Happens: Self-employed individuals are required to pay estimated taxes quarterly, but it’s easy to lose track of deadlines or underestimate what you owe.

- The Consequences: Missing a payment can result in penalties and interest charges, especially if your tax liability is over $1,000, adding unnecessary costs to your tax bill.

- How to Avoid It:

- Mark the quarterly deadlines (April 15, June 15, September 15, and January 15) on your calendar or set reminders.

- Use accounting software to calculate estimated taxes based on your current income.

- Save a percentage of your earnings (typically 25-30%) to cover taxes, so you’re not scrambling to pay when the due date arrives.

3. Misclassifying Personal and Business Expenses

- Why it Happens: Blurred lines between personal and business finances can lead to misclassified expenses, which can cause issues if you’re audited.

- Common Misclassifications:

- Claiming a family vacation as a research trip without proper documentation.

- Using a personal credit card for business purchases and forgetting to log them separately.

- How to Avoid It:

- Use a dedicated business bank account and credit card for all writing-related expenses.

- Keep detailed records and notes about the purpose of each expense (e.g., “Location research for new book set in Paris”).

- Consult a tax professional if you’re unsure about whether an expense qualifies.

Bonus Tips to Steer Clear of Mistakes

- Double-check all forms and numbers before filing to avoid errors.

- Stay updated on tax laws and changes that may affect self-employed individuals.

- If in doubt, work with a tax professional who specializes in creative businesses or freelancers.

When to Hire a Tax Professional

Navigating taxes as a romance author can feel overwhelming, especially if you’re juggling multiple income streams, deductions, and tax obligations. While many authors successfully manage their own taxes, there are times when hiring a tax professional is a smart investment. Here’s how to know when to bring in expert help and what to look for when choosing the right professional.

Benefits of Working with a CPA Experienced in Creative Industries

- Industry Knowledge: A CPA who understands the unique challenges of authors and other creatives can help you maximize deductions specific to your profession, like research trips or marketing costs.

- Time Savings: Taxes can be time-consuming, especially for self-employed individuals. A CPA can handle the complexities for you, freeing you up to focus on your writing.

- Audit Protection: A knowledgeable professional can ensure your tax return is accurate and defensible, reducing the risk of an audit. If an audit does occur, they can represent you and handle the process.

- Strategic Planning: A tax professional can help you with long-term strategies for managing your income, setting up retirement accounts, and planning for future tax liabilities.

Signs You Might Need Professional Help

- Complex Finances: If you have multiple income streams (e.g., royalties, advances, consulting fees) or significant business expenses, a CPA can ensure everything is reported accurately.

- Missed Deadlines: Struggling to keep up with quarterly tax payments or filing deadlines? A CPA can help you stay on track and avoid penalties.

- Frequent Errors: If you’ve made mistakes on past returns or feel unsure about what to report and deduct, professional guidance can give you peace of mind.

- Major Changes: Experiencing a significant life or career change—like signing a big book deal, moving to a new state, or transitioning to full-time writing—can complicate your taxes and warrant expert advice.

- Desire for Optimization: If you’re unsure whether you’re maximizing deductions or paying the right amount in estimated taxes, a CPA can ensure you’re getting the most out of your tax situation.

Questions to Ask When Hiring a Tax Professional

- Do you have experience working with authors or creatives? Look for someone familiar with the unique tax situations of writers.

- Are you familiar with self-employment taxes? Ensure they understand the nuances of self-employment income and deductions.

- What is your process for working with clients? Understand how they handle communication, documentation, and filings to ensure it fits your needs.

- Can you assist with quarterly estimated taxes? If you struggle with these payments, make sure they can provide ongoing support throughout the year.

- What are your fees? Ask for a clear breakdown of costs, including whether they charge hourly, per return, or a flat fee.

- Will you represent me in case of an audit? Having a professional who can handle audits is a valuable safety net.

- Do you offer advice on tax planning and strategy? Beyond filing, some CPAs can help you with long-term financial planning.

Glossary of Tax Terms

Adjusted Gross Income (AGI): An individual’s total gross income minus certain deductions (such as health insurance and student loan interest). This figure is used to calculate an individual’s taxable income.

Business Expenses: The costs associated with running a business, such as office supplies, software, contract labor, travel, and marketing. These expenses are deducted from business income to calculate profit.

1099-K Form: A tax form used to report payments received through third-party payment networks, such as PayPal or Venmo. Used to report your gross income.

1099-NEC Form: A tax form used to report payments made to independent contractors (not employees). Required to be filed if you paid a non-employee worker more than $600 during the tax year.

Home Office Deduction: A tax deduction for a portion of home expenses if part of the home is exclusively used for business.

Internal Revenue Service (IRS): The federal agency responsible for collecting taxes and enforcing tax laws.

Royalty Income: Payments to an author based on the number of copies of their book sold or other licensed usage of their work.

Schedule A: A tax form used to itemize deductions rather than taking the standard deduction.

Schedule C: A tax form used by self-employed individuals to report income or loss from a business.

Schedule E: A tax form used to report income or loss from rental real estate, royalties, partnerships and S corporations, and trusts and estates.

Schedule SE: A tax form used to calculate self-employment tax, which consists of Social Security and Medicare taxes.

Self-Employment Tax: Social Security and Medicare taxes paid by self-employed individuals (the equivalent to what both an employee and employer pay).

Tax Deductions: Expenses that can be subtracted from gross income, reducing the amount of income subject to tax.

Taxable Income: The portion of income that is subject to taxation after all allowable deductions.

The platforms are helpful for quickly finding agents, but visit the agent’s website for updated information and guidelines, as they don’t always keep their profiles on other platforms up to date. Sometimes agent change what they represent or leave the business.

The platforms are helpful for quickly finding agents, but visit the agent’s website for updated information and guidelines, as they don’t always keep their profiles on other platforms up to date. Sometimes agent change what they represent or leave the business.

Note:

Note: